Can I get a mortgage after late payments

If you’ve had late payments or missed payments on your credit record, you might be concerned that getting a mortgage will be challenging. However, while late payments can impact your ability to secure a mortgage, they don’t necessarily mean that homeownership is out of reach. With the right approach and by working with the right specialist lenders, you can still obtain a mortgage after late payments.

People may have the odd missed payment due to simple banking errors. Most high street lenders allow for human error where there is the odd late payment. If there is a history of regular late payments, then this is where it causes an issue with high street lenders. A series of late payments in the last 12-24 months can lead to mortgage application rejection from high-street lenders.

In this article, we’ll explore what lenders look for, how late payments affect your mortgage application, and which mortgage lenders are open to borrowers with a history of missed or late payments.

How Late Payments Affect Your Mortgage Application

Late payments are recorded on your credit report and can lower your credit score, making lenders view you as a higher risk depending on the amount of late payments on your credit file.

The more recent and severe the late payments are, the more they may impact your ability to get a mortgage. Multiple late payments will further decrease your credit score. Most lenders will check your credit report, including any late payments, when evaluating a mortgage application.

However, late payments are only one part of the picture. Many lenders will take other factors into account, such as: Late payments remain on your credit record for six years. Credit reports show any late payments or missed payments to creditors for up to six years.

The number of late payments: A few isolated late payments might not be a dealbreaker, but multiple missed payments over a longer period can indicate a pattern of poor financial management.

The type of credit missed: Missing payments on unsecured credit, such as personal loans or credit cards, might be less damaging than missed mortgage payments or secured loan payments. Lenders view late payments on secured loans, like mortgages, more seriously than on unsecured loans, like credit cards. Mortgage lenders view missed payments on secured debt as more severe than those on unsecured debt, impacting approval chances.

How recent the late payments are: Lenders will be more concerned about late payments that occurred within the last 12 months compared to those that are several years old.

Reasons for late payments: If you had late payments due to a one-time issue, such as redundancy or illness, and you’ve since recovered financially, some lenders may take a more sympathetic view.

What Lenders Look For in a Borrower With Late Payments

Lenders typically assess mortgage applications by considering various factors beyond just your credit score. Here’s what they look for:

1. The Time Since Late Payments

The more time that has passed since your late payments, the better. Most lenders prefer applicants who have shown improved financial behaviour for at least 6 to 12 months. If you’ve made all your payments on time since your late payments, this demonstrates improved financial responsibility. Older late payments are less likely to impact mortgage approval than recent ones.

2. Your Current Credit Score

Although your credit score may have been affected by late payments, showing steady improvement over time will work in your favour. Regular on-time payments on outstanding debts will help boost your score and show lenders you’re back on track. Multiple late payments will further decrease your credit score. Lower credit scores make it harder to qualify for competitive mortgage rates and terms.

3. Affordability and Income

Lenders will want to see evidence that you can afford the mortgage payments based on your current income and financial situation. A solid income and manageable debt levels are critical, especially if your credit history includes late payments.

4. The Deposit Size

A larger deposit can often offset some of the risks associated with late payments. If you can provide a deposit of 15-25%, lenders may be more willing to approve your mortgage application, even with a history of late payments. Many specialist lenders require applicants with late payments to provide a larger deposit than those with a clean credit history.

5. The Severity of Late Payments

Lenders will consider how serious your late payments were. For instance, if your late payments were only a few days overdue, some lenders may overlook them. However, defaults, arrears, or missing several months of payments are more serious and will impact your chances more significantly.

How to Improve Your Chances of Getting a Mortgage After Late Payments

If you’ve had late payments in the past but want to improve your chances of getting a mortgage, here are a few steps to take:

1. Check and Improve Your Credit Report

Before applying for a mortgage, it’s essential to check your credit report. Look for any errors or inaccuracies that could be negatively affecting your credit score. You can improve your score by making payments on time, keeping credit card balances low, and avoiding new credit applications. Being registered on the electoral roll can positively influence your credit score.

2. How much Deposit

If you’ve had late payments, saving for a larger deposit can significantly increase your chances of mortgage approval. The higher deposit the less riskier you appear to lenders. Aim for a minimum of 10-15% but strive for 20-25% if possible.

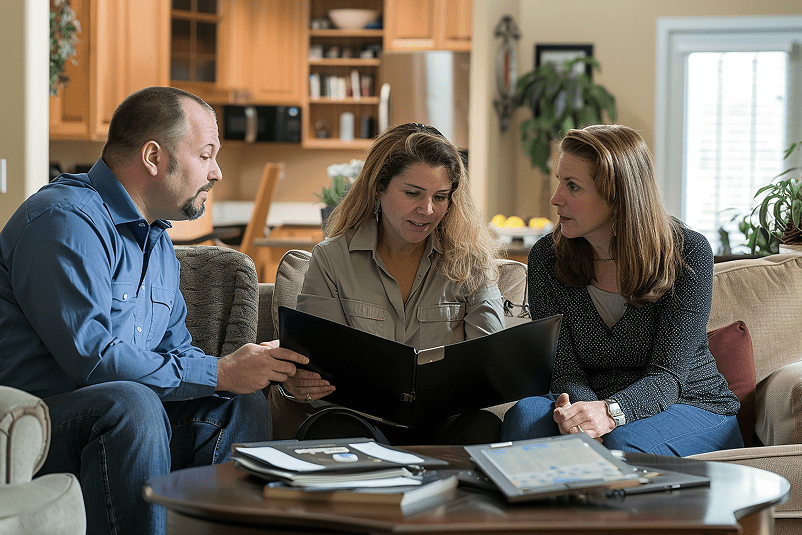

3. Work with a Specialist Mortgage Broker

A specialist mortgage broker can help you find lenders that are more open to borrowers with adverse credit, including late payments. They have access to a wide range of lenders and can help match you with one that fits your financial profile.

4. Provide Evidence of Financial Stability

Lenders want to see that your financial situation has improved since your late payments. Make sure you have a solid income and low debt-to-income ratio. Providing evidence of regular, stable income will reassure lenders that you can meet your mortgage payments.

5. Be Honest About Your Credit History

When applying for a mortgage, it’s essential to be upfront about your credit history. Hiding late payments will only cause issues later in the process, and lenders appreciate transparency.

High Street Lenders Who May Consider Mortgages After Late Payments

High street lenders are a possibility depending on how many missed payments. High-street lenders typically use an automated decision-making process that may lead to automatic declines for applicants with late payments. Here are some of the lenders that offer mortgages to individuals with bad credit, including late payments.

Working with a specialist mortgage broker helps as they will check lenders criteria and find the right mortgage options based on your individual situation.

Lender | Late Payment Criteria | Time Since Last Missed Payment | Max LTV | Additional Notes |

Barclays | May accept applications with isolated late payments, provided the overall credit profile is strong. | Case-by-case basis. | Up to 90% | Emphasizes overall creditworthiness; recent financial stability is crucial. |

HSBC | Generally does not accept applicants with any late payments in the last 12 months. | Over 12 months. | Up to 90% | Requires a clean credit record for at least 12 months before application. |

Nationwide | Allows up to one late payment in the last 12 months, provided there are no other adverse credit issues. | 12 months or more. | Up to 95% | Emphasizes recent financial stability; late payments should be isolated incidents. |

Santander | Does not accept applicants with a missed mortgage payment in the last 12 months or two or more missed payments on unsecured loans in the last 12 months. | Over 12 months. | Up to 90% | Strict criteria regarding recent missed payments; emphasizes clean recent credit history. |

Metro Bank | May allow up to two missed or late payments in the last two years on unsecured lending, provided they are not outstanding at the time of application. | 24 months or more. | Up to 85% | Considers applicants with minor credit issues; emphasizes that missed payments are resolved. |

Leeds Building Society | Allows a maximum of one missed mortgage or secured loan payment in the last 12 months; no more than two months arrears on any credit agreement in the previous 24 months. | 12–24 months. | Up to 95% | Emphasizes the importance of maintaining up-to-date payments; recent arrears are considered cautiously. |

Lloyds Bank | May consider applications with isolated late payments, provided there is a satisfactory explanation and the overall credit profile is strong. | Case-by-case basis. | Up to 90% | Emphasizes overall creditworthiness; recent financial stability is crucial. |

Halifax | May accept applications with isolated late payments, provided there is a satisfactory explanation and the overall credit profile is strong. | Case-by-case basis. | Up to 90% | Emphasizes overall creditworthiness; recent financial stability is crucial. |

Virgin Money | May consider applications with late payments older than 12 months, provided there are no other adverse credit issues. | Over 12 months. | Up to 90% | Emphasizes recent financial stability; late payments should be isolated incidents. |

Skipton Building Society | Offers various products accommodating different levels of credit issues, specific criteria regarding late payments are assessed on a case-by-case basis. | Case-by-case basis. | Up to 95% | Provides flexible options for applicants with minor credit issues; emphasizes overall financial stability. |

What our customers say

Marlon

25 Apr 2025

Showing our favourite reviews

Always attentive, helpful and efficient

Jonathan, 27 Jan 2025

Best Mortgage Broker in the UK!

Liam, 26 Nov 2024

Ben was really helpful in helping me…

George, 28 Aug 2024

Specialist lenders Who May Consider Mortgages After Late Payments

Lender | Late Payment Criteria | Time Since Last Missed Payment | Max LTV | Additional Notes |

Bluestone Mortgages | Considers applicants with multiple missed payments; focuses on recent financial behavior rather than historical issues. | No minimum; recent payments considered. | Up to 90% | Manual underwriting; no credit scoring. Suitable for applicants with complex credit histories. |

Pepper Money | Accepts applicants with late payments registered over 6 months ago; unsatisfied defaults considered. | 6 months or more. | Up to 85% | Tiered product range based on severity and recency of credit issues. Flexible criteria for self-employed applicants. |

Kensington Mortgages | Requires all late payments to have been paid at least 6 months before application; unsatisfied defaults considered on a case-by-case basis. | 6 months or more. | Up to 90% | Manual underwriting; considers applicants with complex income structures. |

Vida Homeloans | Accepts applicants with late payments over 3 months old; no limits on the number if over six months old. | 3 months or more. | Up to 85% | Specializes in complex income and credit profiles; suitable for self-employed applicants. |

Aldermore | Will consider applicants with late payments older than 6 months; unsatisfied defaults considered depending on circumstances. | 6 months or more. | Up to 85% | Manual underwriting; considers applicants with complex income structures. |

Mansfield Building Society | Offers various products accommodating different levels of credit issues: Standard Lending (no missed payments in last 6 months), Versatility (no more than status 2 in last 24 months), Versatility Plus (no more than status 2 in last 24 months), Credit Repair (up to 1 missed payment in last 3 months and no more than 5 in last 12 months). | Varies by product; up to 3 months for Credit Repair. | Up to 85% | Manual underwriting; considers applicants with complex income structures. |

Accord Mortgages | Allows up to 1 missed mortgage payment within the last 24 months; all payments must have been made within one calendar month of the due date to avoid being classed as arrears. | No missed payments in the last 12 months. | Up to 95% | Adverse credit considered under specific conditions; manual underwriting applies. |

InterBay Commercial | Does not accept applicants with mortgage/rent arrears in the last 12 months; applicants with a County Court Judgment (CCJ) or default of any amount in the last three years will not normally be considered. | No mortgage/rent arrears in the last 12 months. | Up to 75% | Manual underwriting; considers applicants with complex income structures. |

Buckinghamshire Building Society | Considers applicants with late payments; specific criteria not publicly disclosed. | Case-by-case basis. | Up to 80% | Manual underwriting; considers applicants with complex income structures. |

Darlington Building Society | Allows one missed payment on consumer credit agreements in the last 12 months; for missed loan payments, customers are expected to have none in the last three years. | 12 months for consumer credit; 3 years for loan payments. | Up to 90% | Manual underwriting; considers applicants with complex income structures. |

Conclusion

Securing a mortgage after late payments is possible, but it requires careful planning and working with the right lenders. Many high street lenders may hesitate to approve applications from borrowers with a poor payment history, but several specialist lenders, including Pepper Money, Aldermore, and Bluestone Mortgages, are willing to offer mortgages to those who have experienced credit issues. Specialist lenders often have a proven track record of success in approving applications from individuals with bad credit. Specialist mortgage lenders are more likely to consider applications from individuals with late payments.

To improve your chances of success, check your credit report, work on building up a larger deposit, and consult a specialist mortgage broker who can help you navigate the market and find the best lender for your situation. With the right strategy, securing a mortgage after late payments can be within reach, helping you move forward towards homeownership.

Get help from an experienced mortgage broker.

You can speak to one of our expert mortgage advisors who would be able to guide you through the process. They will advise if there is a lender available and the maximum loan amount based on your circumstances. We are a whole of market mortgage brokerage with access to all lenders. Call us on 01332 470400 or complete the form with your details for us to give you a call back.

Why Work with Option Finance for Bad Credit Mortgages?

At Option Finance, we specialise in mortgages for complex credit scenarios. Our team works with all major bad credit lenders and has access to exclusive deals that aren’t available on the high street.

Understanding one’s credit report from a credit reference agency can help in securing a mortgage.

Over 20 years of experience

Full market access to specialist lenders

Fast, honest, and personalised mortgage advice

Expert help with complex or recent credit issues

Showing our favourite reviews

Always attentive, helpful and efficient

Jonathan, 27 Jan 2025

Best Mortgage Broker in the UK!

Liam, 26 Nov 2024

Ben was really helpful in helping me…

George, 28 Aug 2024

FAQs

Can I get a mortgage with late payments on my credit report?

Yes, you can still get a mortgage even with late or missed payments on your credit file. While high street lenders may be stricter, especially with recent or multiple late payments, specialist lenders like Bluestone Mortgages and Pepper Money are more flexible and assess your overall financial picture.

How long do late payments stay on my credit report?

Late payments remain on your credit report for six years. Their impact lessens over time, especially if you maintain good payment behaviour moving forward. Lenders often place more weight on recent late payments (within the last 12 months).

How recent is too recent for late payments when applying for a mortgage?

Most lenders prefer no late payments in the last 6 to 12 months, but some specialist lenders may consider applicants with late payments as recent as three months ago, depending on the severity and reason.

Which lenders accept mortgage applications after late payments?

High street lenders like Nationwide, Halifax, and Barclays may accept isolated late payments if your overall profile is strong. For more flexibility, specialist lenders such as:

- Pepper Money

- Bluestone Mortgages

- Kensington

- Vida Homeloans

…are more open to applicants with multiple or recent late payments.

How can I improve my mortgage chances after late payments?

To boost your chances:

- Check and fix your credit report

- Build a larger deposit (15–25%)

- Avoid further missed payments

- Provide proof of income and financial stability

- Work with a specialist mortgage broker who can match you with lenders based on your unique situation

Ready to Take the First Step?

Whether you’re a first-time buyer, remortgaging, or moving home, bad credit doesn’t have to hold you back.

Understanding credit scoring can help you prepare for a mortgage application. You can speak to one of our specialist mortgage brokers who would be able to guide you through the process. They will advise if there is a lender available and the maximum loan amount based on your circumstances. We are a whole of market mortgage brokerage with access to all lenders.