Getting a Mortgage After an Individual Voluntary Arrangement (IVA)

Introduction to IVAs and Mortgage Implications

Getting a mortgage after an Individual Voluntary Agreement (IVA) can be challenging, but it’s not impossible. An IVA is a legally binding agreement between an individual and their creditors to manage debts and liabilities. Understanding how an IVA affects your credit history and mortgage chances is crucial in navigating the process.

A specialist mortgage broker can help you find the right lender and mortgage product, even with a history of bad credit. It’s essential to know that an IVA will impact your credit score and can have long-lasting effects on your ability to obtain credit, including mortgages.

Understanding IVA’s?

An Individual Voluntary Arrangement (IVA) is a formal agreement between you and your creditors to repay your debts over a set period of time, typically five to six years. Having an IVA on your credit record negatively impacts your overall credit score.

Clearing debt is crucial for improving your financial health, and an IVA can be an effective solution to manage and clear debt when full repayment is not feasible.

A qualified insolvency practitioner will help establish your IVA by creating a repayment plan tailored to your budget and explain which debt solutions could be right for you. For the IVA to take effect, it must receive approval from the court and be officially recorded as a legally binding agreement in the Insolvency Register.

Once your creditors accept the active IVA, any additional charges and interest will be frozen. They will not be able to request payments from you throughout the duration of the IVA.

When the IVA period has passed, providing you have kept up with the payments, any remaining debt that was not paid off over the course of the arrangement should be written off. This means you will no longer owe anything to your creditors. Subsequently, the record of your IVA will be officially removed from the Insolvency Register.

While an IVA can help you manage your debt, it can also leave a lasting impact on your credit report. This will make it more challenging to secure credit in the future, including a IVA mortgage. However, obtaining a mortgage post-IVA is not impossible. Many lenders are open to working with individuals who have completed an IVA, as long as certain conditions are met.

In this article, we’ll explore how an IVA affects your ability to get a IVA mortgage, how to improve your chances of approval, and which lenders may consider offering mortgages to people with an IVA on their credit history.

Credit History and IVA

An IVA significantly affects your credit report, reducing your ability to borrow. The IVA will remain on your credit file for up to six years, and lenders will view it as a sign of past financial difficulties. However, with careful management of your finances during and after the IVA, you can begin to rebuild your credit.

Regular payments and a stable financial situation can help improve your credit rating. It’s also important to check your credit file with the main credit reference agencies. This ensures that your IVA is recorded correctly and that there are no other errors or inaccuracies.

How Does an IVA Affect Getting a Mortgage?

An IVA remains on your credit report for six years from the date it was registered. During this time, and even after the IVA has been completed. Getting a mortgage after an IVA may involve higher interest rates compared to borrowers without an IVA.

Mainstream mortgage lenders are likely to see you as a higher-risk borrower with poor credit. As a result, securing a mortgage with traditional high street banks may be difficult due to the IVA classed as bad credit.

Individuals with an IVA may need to provide higher deposits, typically ranging from 15% to 25%, to mitigate the risk for lenders.

Lenders will consider various factors, including:

- When the IVA was registered: The further in the past the IVA is, the more flexible lenders are likely to be. After the six-year mark, the settled IVA will drop off and will no longer show on your credit report, significantly improving your chances.

- Whether the IVA has been satisfied: Lenders prefer applicants who have successfully completed and satisfied their IVA, as it demonstrates an ability to manage debt responsibly. You should check your credit file for any inaccuracies after your IVA is settled.

- Your current financial situation: Lenders will assess your financial conduct after the IVA, including your income, current debt levels, and how well you’ve rebuilt your credit score.

Although an IVA presents challenges, many specialist mortgage lenders are willing to offer mortgages to individuals with past credit issues, including an IVA.

Can You Get a Mortgage During or Immediately After an IVA?

It’s highly unlikely that you’ll be able to get a mortgage during an IVA, as lenders generally won’t offer loans to individuals currently in an IVA. If you’re still repaying your debts under the IVA agreement, most lenders will see you as a high-risk borrower with bad credit.

While the IVA is ongoing, your credit report reflects serious financial hardship, and your finances are legally controlled under the agreement meaning you must get written consent from your IVA insolvency practitioner to take on any new credit over £500, including a mortgage. Most high street lenders will automatically decline applications from borrowers currently in an IVA.

Once the IVA is settled, get Proof Your IVA is Complete Ask your Insolvency Practitioner (IP) for a completion certificate. The six-year period begins before it drops off your credit file. You can now start working toward securing a mortgage. While your options may be limited during the first few years post-IVA, improving your financial health and seeking out specialist lenders can increase your chances of getting approved for a mortgage.

Expect higher interest rates and stricter affordability checks until you re-establish a strong credit profile.

Which Lenders Offer Mortgages After an IVA?

Several specialist mortgage lenders in the are open to working with individuals who have had an IVA. These lenders have more flexible criteria than mainstream banks. This is due to stricter lending criteria and consider applicants with adverse credit histories on a case-by-case basis. Below are some lenders that may be willing to offer a mortgage after an IVA:

| Lender Name | Specialisation & Criteria |

|---|---|

| Precise Mortgages | Specialises in mortgages for borrowers with bad credit, including those who completed their IVA at least 12 months ago. Considers current financial stability and deposit size. |

| Kensington Mortgages | Offers mortgage products for individuals with complicated credit histories, including past IVAs. More flexible if the IVA was satisfied a few years ago with demonstrated financial responsibility. |

| The Mortgage Lender | Works with borrowers who have faced bad credit difficulties, including IVAs. Offers competitive mortgage rates for those who have improved their financial situation post-IVA. |

| Bluestone Mortgages | Specialist lender for individuals with past bad credit, including IVAs. Considers applications case-by-case, focusing on time since IVA and current financial health. |

| Aldermore | Known for leniency with adverse credit histories including IVAs. Prefers IVAs satisfied more than two years ago; evaluates applications individually. |

Some lenders also offer equity release products, which can serve as a solution for clients with various financial situations.

Tips for Getting a Mortgage After an IVA

While obtaining a mortgage after an IVA can be challenging, the following steps can help you improve your chances of approval:

Rebuild Your Credit Score

Your credit history records all credit activity for the past six years. Rebuilding your credit rating after an IVA is essential for improving your mortgage options. Always check your report with main credit reference agencies. The main agencies used by lenders are as follow:

Checkmyfile, Experian, Equifax and transunion.

Here are some ways to boost your credit score:

- Pay all your bills on time.

- Keep your credit utilisation low (ideally below 30% of your available credit limit).

- Avoid applying for too much new credit at once.

- Consider getting a credit-builder credit card and using it responsibly.

- Registering to vote on the electoral register can improve your credit rating by reducing perceived risk.

A higher credit score will make you a more attractive applicant to lenders and could lead to better mortgage deals.

How Much Deposit Will Be Needed?

Most lenders require a larger deposit for individuals with an IVA to reduce risk. If the IVA was settled within the last three to four years, lenders may require a higher deposit, between 15% and 25% when applying for a mortgage after an IVA.

Individuals with an IVA must adhere to structured repayment plans with monthly payments over a set period, typically five to six years. A larger deposit reduces the lender’s risk, which makes them more likely to approve your application. It can also help you secure a more competitive interest rate.

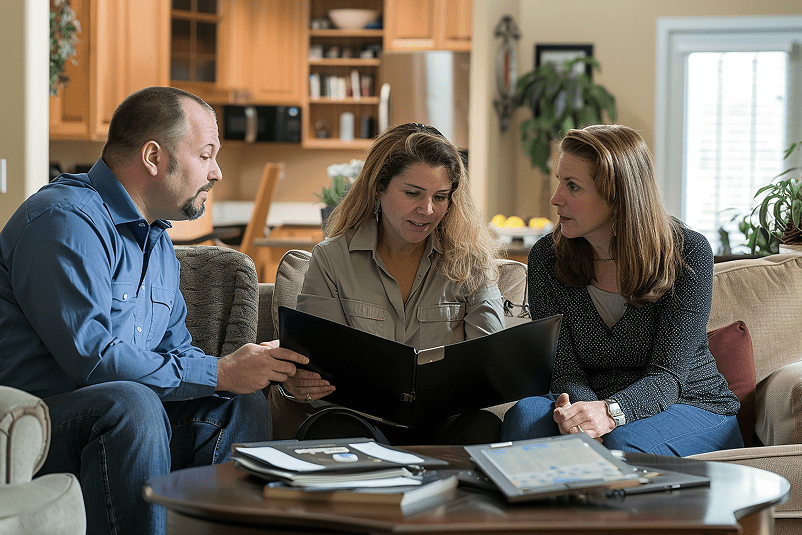

Work with a Specialist Mortgage Advisor

A specialist mortgage advisor experienced in bad credit mortgages can be invaluable in finding the right lender for you. Brokers have access to a wide range of lenders, including those who are more willing to accept applicants with poor credit histories. They can help you navigate the application process and increase your chances of approval.

Demonstrate Financial Stability

Lenders will want to see that you’ve gained control of your finances since your IVA. Show that you have a steady income, no recent missed payments, and manageable levels of debt. This demonstrates to lenders that you’re a responsible borrower who can manage a mortgage.

An IVA can have a negative impact on your credit score for up to six years, increasing perceived risk for lenders.

5. Consider Joint Applications

If your partner or co-applicant has a stronger credit history, applying for a joint mortgage could improve your chances of approval. Lenders will look at both applicants’ credit profiles, and a strong financial history from one party may offset the impact of the IVA on the other.

Assessing credit reports can influence lending decisions, particularly in joint mortgage scenarios where one applicant’s stronger credit can benefit the overall application.

6. Avoid New Missed Payments or Defaults

Post-IVA, lenders want to see you’ve learned from past mistakes. Maintain a clean credit history with no late payments, defaults, or new arrangements. Even small utility or phone bill issues can set your mortgage application back.

7. Gather Full Documentation

IVA mortgage applications are more document-heavy. You’ll typically need:

- Proof of income (payslips, tax returns)

- Bank statements

- Proof of IVA discharge

- Deposit source evidence

Being organised can speed up approval and improve lender confidence.

8. Avoid Payday Loans or High-Cost Borrowing

Using payday loans or similar products after your IVA signals financial instability. Most lenders view these negatively, and they can damage your mortgage prospects.

How Long After an IVA Can You Get a Mortgage?

The length of time since your IVA was completed plays a significant role in your chances of getting a adverse credit mortgage. Here’s a general guide to how soon you can expect to apply:

- During an IVA: It’s unlikely you’ll be able to get a mortgage while still in an IVA.

- 1-2 years after IVA: You’ll have limited options during the first two years after completing your IVA, but some specialist lenders may consider your application if you have a large deposit and good post-IVA financial conduct.

- 3-6 years after IVA: More lenders will be willing to consider your application as the IVA gets older, especially if your financial situation has improved.

- After 6 years: Once the IVA is removed from your credit report, you’ll have more mortgage options, including from mainstream lenders, provided your credit score has improved and you’ve demonstrated financial responsibility.

Paying Off Debt with a Lump Sum

Paying off debt with a lump sum can be an effective way to improve your credit score and increase your chances of getting a mortgage. However, if you’re still in an IVA, you may need to consider the windfall clause, which requires you to pay any unexpected funds towards your debts.

It’s essential to review your IVA agreement and consult with your insolvency practitioner before making any lump sum payments. Additionally, you should also consider the impact of a lump sum payment on your credit report and overall financial situation.

Mortgage Affordability Checks

Mortgage affordability checks are a critical step in the mortgage application process. Lenders will assess your income, expenses, and debt obligations to determine how much you can afford to borrow. If you’ve had an IVA, you may need to provide additional documentation, such as a completion certificate, to demonstrate your financial stability.

A specialist mortgage broker can help you prepare for the affordability checks and ensure that you’re presenting your financial situation in the best possible light. It’s also essential to understand that mortgage affordability checks will vary depending on the lender and your individual circumstances, so it’s crucial to work with a knowledgeable and experienced broker.

How Do Windfalls Work in an IVA?

If you’re in an Individual Voluntary Arrangement (IVA) unexpected funds during an IVA can include lottery wins, inheritances, insurance payouts, and severance packages.. This must be reported to your IVA supervisor immediately. Windfalls are considered extra income and, under the terms of your IVA, you’re usually required to pay some or all of the windfall into your arrangement.

This helps ensure your creditors receive more of what they’re owed. A windfall can prevent you from saving for a mortgage deposit if the funds are redirected to pay off the IVA. Failing to disclose a windfall can result in serious consequences, including the potential termination of your IVA and legal action. Understanding how windfalls affect your IVA is vital for staying compliant and avoiding further financial issues.

Once the IVA is fully settled, any windfall clause is no longer applicable, allowing the individual to keep future unexpected funds. Once the IVA is fully settled, any windfall clause is no longer applicable, allowing the individual to keep future unexpected funds.

Conclusion

Take Your Time Getting a mortgage is a big decision, so it’s important to explore your options carefully.

Getting a mortgage after an Individual Voluntary Agreement (IVA) can be challenging, but it’s entirely possible with the right approach. While high street lenders may be less willing to approve applications from individuals with a past IVA, there are several specialist lenders who can offer mortgages tailored to people with poor credit scores.

By taking steps to rebuild your credit score, saving for a larger deposit, and working with a specialist mortgage broker can help with mortgage approval. To improve your credit score after an IVA, you should pay off any other debts not included in the IVA. You can significantly improve your chances of securing a mortgage post-IVA. Don’t let a past IVA stop you from achieving your dream of homeownership, there are lenders who are willing to work with you to find the right mortgage for your circumstances.

Get help from an experienced mortgage broker.

You can speak to one of our specialist mortgage brokers who would be able to guide you through the process. They will advise if there is a lender available and the maximum loan amount based on your circumstances. We are a whole of market mortgage brokerage with access to all lenders. Call us on 01332 470400 or complete the form with your details for us to give you a call back.

What our customers say

Marlon

25 Apr 2025

Showing our favourite reviews

Always attentive, helpful and efficient

Jonathan, 27 Jan 2025

Best Mortgage Broker in the UK!

Liam, 26 Nov 2024

Ben was really helpful in helping me…

George, 28 Aug 2024

FAQs

Can I get a mortgage if I’ve had an IVA?

Yes, it’s possible to get a mortgage after an IVA, but it can be more challenging. Most high street lenders may be cautious, but many specialist lenders consider applicants with past credit issues.

What is an IVA and how does it affect my credit score?

An Individual Voluntary Arrangement (IVA) is a legally binding agreement to repay debts over time. It typically lasts five to six years and significantly impacts your credit score during that period.

How long does an IVA stay on my credit file?

An IVA remains on your credit file for six years from the date it was registered, even if it is completed earlier. After six years, it should be automatically removed.

Can I apply for a mortgage during an active IVA?

It’s extremely unlikely. While in an IVA, you must get your insolvency practitioner’s permission to borrow more than £500—and most lenders won’t approve mortgage applications during this time.

How soon after an IVA can I apply for a mortgage?

0–2 years after IVA: Very limited options

3–6 years: More lenders will consider your application

After 6 years: The IVA no longer shows on your credit file, and more mainstream lenders may be open to offering you a mortgage

Ready to Take the First Step?

Whether you’re a first-time buyer, remortgaging, or moving home, bad credit doesn’t have to hold you back.

Understanding credit scoring can help you prepare for a mortgage application. You can speak to one of our specialist mortgage brokers who would be able to guide you through the process. They will advise if there is a lender available and the maximum loan amount based on your circumstances. We are a whole of market mortgage brokerage with access to all lenders.